Megaworld Q3 2025 Earnings Report:Why Did Profits Stall Despite Strong Office and Mall Performance?

- bedandgoinc

- 2025年11月25日

- 読了時間: 3分

更新日:2025年11月27日

November 25,2025

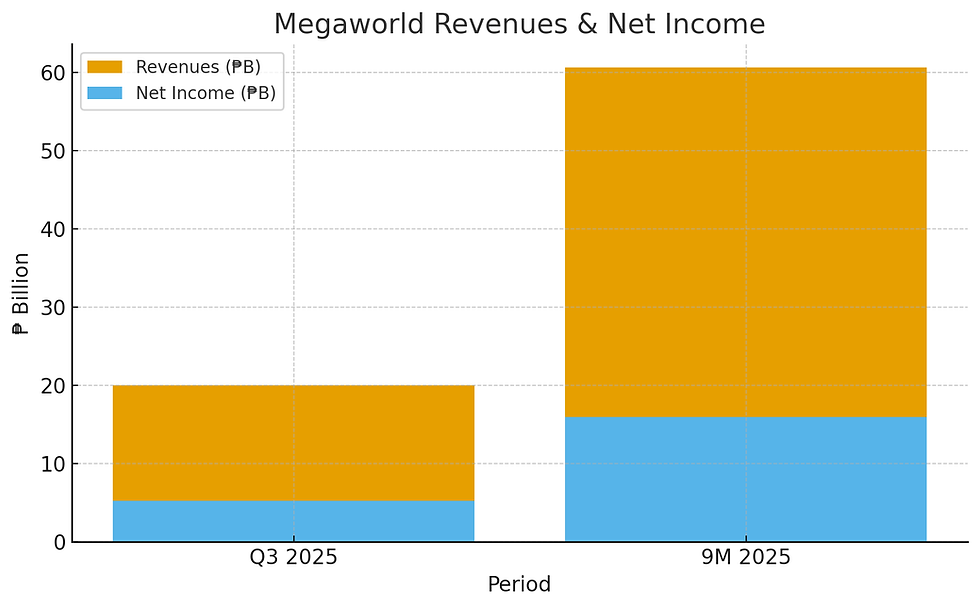

Megaworld Corporation posted mixed results in the third quarter of 2025 as steady leasing and hotel performance helped offset higher costs and weaker residential margins. While quarterly profits softened, the company's nine-month performance painted a far more optimistic picture—highlighting sustained growth across offices, malls, hotels, and townships.

Soft Third Quarter, but Leasing and Hotels Keep Earnings Afloat

In the July-to-September period, Megaworld’s attributable net income edged up 1.16% to ₱5.23 billion, while consolidated revenues rose 4.34% to ₱19.96 billion, according to its stock exchange disclosure.

The modest increase came amid higher expenses—up 1.62% to ₱12.54 billion—and thinner margins in its residential segment.

Real estate sales, which remain Megaworld's largest revenue contributor, inched up 0.84% to ₱13.13 billion. Meanwhile:

Rental income climbed to ₱5.51 billion

Hotel operations generated ₱1.32 billion

President Lourdes Gutierrez-Alfonso said the quarter reflected the resilience of Megaworld's recurring income base and continued demand for residential and hotel products, even as market conditions turned mixed.

Nine-Month Results Tell a Different Story: Strong Growth and Recurring Income Momentum

Despite a softer Q3, Megaworld delivered a robust nine-month performance.

Attributable net income surged 16% to ₱15.93 billion

Revenues climbed 8.91% to ₱60.61 billion

Real estate sales: ₱40.24B

Rental income: ₱16.24B

Hotel revenues: ₱4.13B

Even with Q3 volatility, Megaworld's recurring income segments—offices, retail, and hotels—remained powerful growth drivers.

Leasing Strength: Offices and Malls Lead the Charge

Megaworld's office leasing business continued to outperform the broader market. The company secured:

140,000 sqm in new leases

120,000 sqm in renewals

Demand remained fueled by BPO firms and multinational companies expanding footprints within Megaworld’s integrated townships.

Office leasing revenues rose 15–16% year-on-year to more than ₱11 billion, underscoring the sector’s steady recovery and rising rental escalations.

Megaworld Lifestyle Malls also posted strong results, booking ₱5.1 billion in leasing revenues, up 13%. Higher foot traffic, stronger tenant expansion, and improving consumer activity across sites like Uptown Bonifacio, Eastwood City, and Lucky Chinatown supported this performance.

Hotel Business Rebounds as Travel Confidence Returns

Hotels contributed ₱4.13 billion, up 13%, boosted by higher room rates and new hotel openings—most notably the Grand Westside Hotel. The hospitality segment continues to benefit from rising domestic travel, MICE events, and growing tourist arrivals.

Residential: Stable Performance with Standout Projects

Real estate sales rose 6% year-to-date to ₱40.24 billion, supported by steady take-up and construction progress in key projects:

Uptown Bonifacio, Taguig

ArcoVia City, Pasig

Maple Grove, Cavite

The Upper East, Bacolod

Megaworld also made headlines with the launch of the Megaworld Luxe Collection, signaling a bold entry into the ultra-luxury residential market.

Township Strategy Remains Core to Long-Term Growth

Megaworld now operates 36 township developments across ~7,000 hectares. The developer plans to launch another township outside Metro Manila before year-end, reinforcing its township-led approach—a strategy that integrates residential, commercial, office, hotel, and lifestyle components into unified estates.

The company also continued generating shareholder value through:

A ₱0.094 per share cash dividend

A ₱2-billion share buyback program

Both reflect confidence in its financial position and long-term growth trajectory.

Market Insight: What’s Next for Megaworld?

Analysts note that fourth-quarter performance will depend on:

Leasing resilience, especially in offices

Holiday-driven mall traffic

Hotel seasonality boosts

Project completions feeding residential revenue

However, risks remain.Toby Allan Arce of Globalinks Securities highlighted that elevated interest rates and inflationary pressures may dampen housing demand. Even so, he expects recurring income—particularly offices and retail—to remain the primary growth engine heading into 2025.

Long-Term Outlook: A Bigger Leasing Portfolio by 2030

By 2030, Megaworld aims to expand:

Office GLA to 2 million sqm

Retail GLA to 1 million sqm

This would bring its total leasing portfolio to a massive 3 million square meters, strengthening its position among the country's largest landlords.

Sources:

https://insiderph.com/megaworlds-9-month-2025-earnings-climb-to-p18b-buoyed-by-townships-rentals https://businessmirror.com.ph/2025/11/05/weak-q3-results-fail-to-dent-megaworld-9-month-income/

コメント