DMCI Q2 2025 Profit Drops 27% to ₱4.02B on Weaker Core Units

- bedandgoinc

- 2025年8月26日

- 読了時間: 3分

August 26,2025

DMCI Holdings Inc. reported a sharp decline in its second-quarter earnings, with net income plunging 27% to ₱4.02 billion from ₱5.53 billion a year earlier. The drop was mainly driven by softer performances in its coal, real estate, and construction businesses, alongside the ongoing integration of its cement operations.

Despite these headwinds, the conglomerate managed to grow revenues by 6% to ₱29.74 billion, supported by stronger contributions from nickel mining, off-grid power, and its water distribution unit, Maynilad. Management emphasized that while the business transition phase is pressuring short-term profitability, DMCI’s diverse portfolio and engineering ecosystem provide a strong foundation for long-term growth.

Segment Performance Breakdown

Coal and Power: Lower Prices Hit Earnings

Semirara Mining and Power Corporation (SMPC), DMCI's largest earnings contributor, posted ₱2.3 billion in Q2, a 32% drop from ₱3.4 billion last year. The decline was largely due to softer energy market conditions and lower coal selling prices, although record-high coal shipments and power sales helped partially offset the downturn.

Real Estate: Earnings Down Despite Revenue Growth

DMCI Homes reported ₱678 million in profit, an 8% decrease from last year's ₱737 million. While revenue recognition improved from newly qualified accounts, profitability was weighed down by higher operating and finance costs.

Construction: Margins Under Pressure

The construction arm, D.M. Consunji, Inc., recorded a steep decline in contributions—just ₱18 million compared to ₱250 million last year. The drop stemmed from project delays, rising costs, and conservative revenue recognition practices, which squeezed margins in an already competitive sector.

Cement: Ongoing Integration Challenges

Concreat Holdings Philippines Inc., DMCI’s cement business, posted a ₱682-million net loss in Q2. Losses were linked to high interest expenses and weaker revenues, though management emphasized that recovery efforts are underway through operational efficiencies and improved distribution networks.

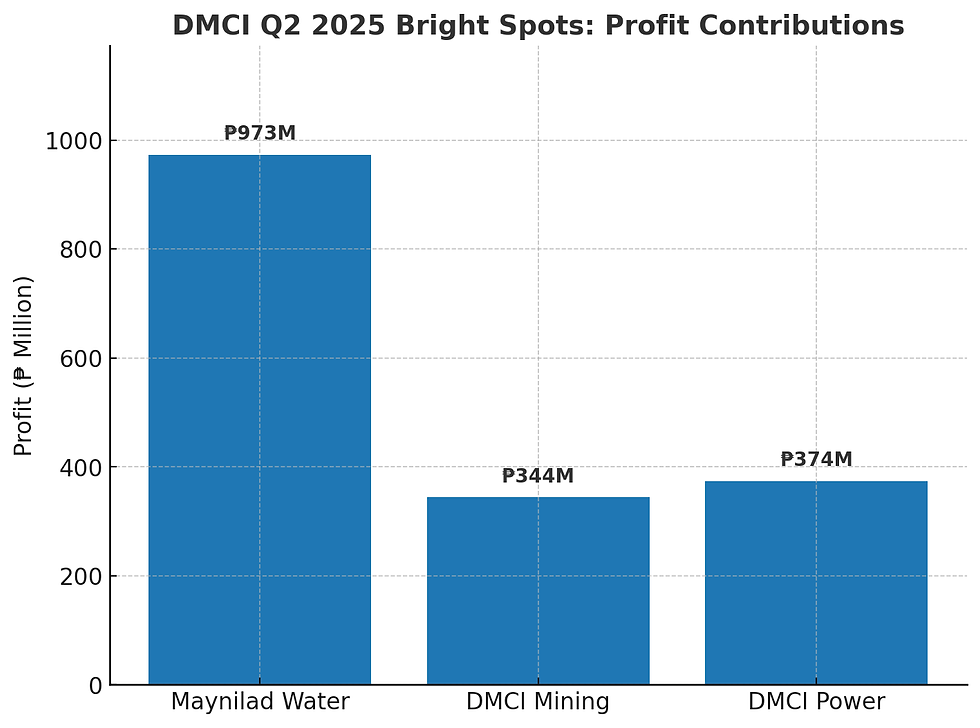

Bright Spots in the Portfolio

Despite the drag from core units, other segments helped temper the decline:

Water: Maynilad Water Services, an associate company, grew its earnings by 33% to ₱973 million, driven by higher average effective tariffs and disciplined cost management.

Nickel Mining: DMCI Mining posted a turnaround performance, swinging to a ₱344-million net income from a ₱43-million loss last year, boosted by improved selling prices and operational efficiency at Zambales Chromite Mining Company.

Off-Grid Power: DMCI Power delivered ₱374 million, up 5% from ₱355 million, thanks to higher energy sales and the addition of new wind and bunker-fired power capacities in Palawan and Antique.

Management Outlook

Chairman and CEO Isidro A. Consunji stressed that the ongoing business transition and integration will take time but highlighted the strength of DMCI's diverse business mix.

“Business transition and integration take time, but our diverse business mix and engineering ecosystem continue to support the Group. We believe that the improvements we are making today will lead to meaningful value for our stakeholders in the long run,” Consunji said.

DMCI also maintained a healthy financial position at the end of June, with a net gearing ratio of 22% and a current ratio of 2.4x, indicating sufficient liquidity to manage its transition period.

Market Reaction

Following the Q2 earnings release, DMCI shares rose slightly by 0.20% to ₱10.22 apiece, reflecting cautious investor optimism. Analysts note that while short-term profitability pressures remain, the group's portfolio diversification—particularly the strength of its water and nickel businesses—provides stability as cement and construction challenges are addressed.

DMCI's second-quarter results underscore the growing importance of portfolio balance in navigating sector-specific headwinds. While coal, real estate, and construction faced earnings declines, recovery in mining, water utilities, and off-grid power provided resilience. The integration of cement remains a near-term challenge, but long-term prospects hinge on how well DMCI leverages its engineering ecosystem to restore profitability across its core businesses.

Source:

コメント